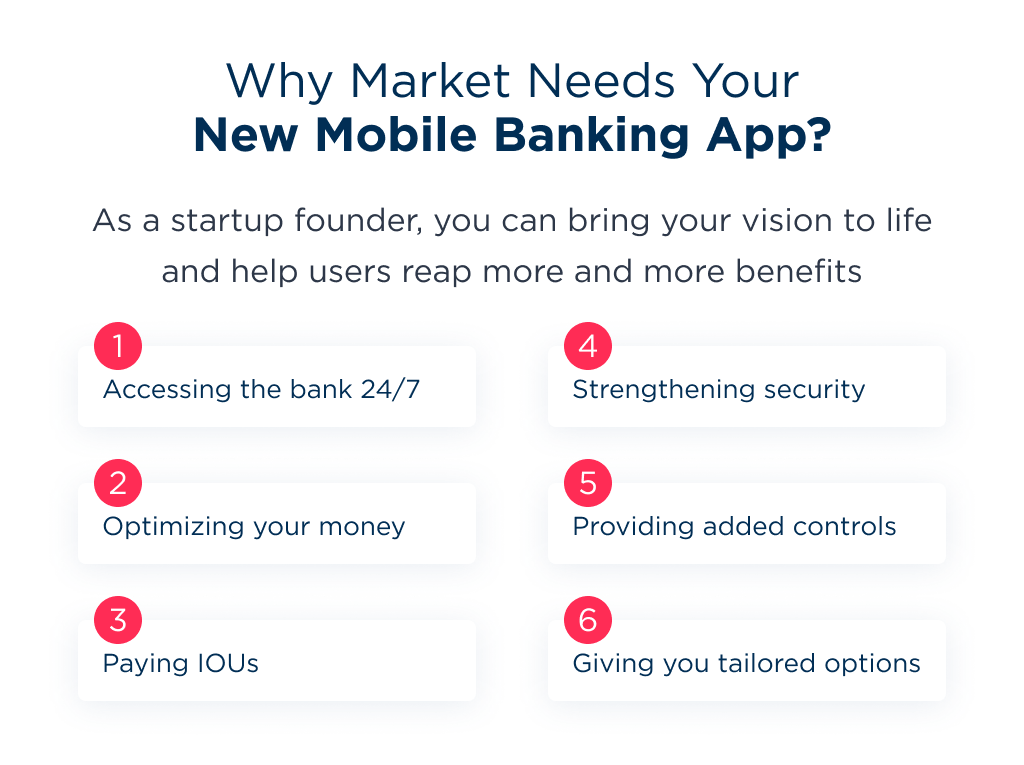

The rise of digital devices has made everything easily accessible for us, even your bank. Today, there is no need to go to your bank branch to transfer cash or check your account status.

One can simply do this using a banking app on their smartphone.

To your surprise, these apps have gained a lot of popularity in the last ten years. As per Statista, there are around 57 million mobile banking users in the US.

Moreover, the primary use of mobile banking apps is done by users for checking the balance. Around 90% of the users use mobile banking apps to check balance and 79% use them to view their transactions.

All these stats prove that the idea of banking app development will be a goldmine for you in the coming time.

If you are in for this, then keep reading to know more!

A Quick Refresher

Here are some more stats that favor the idea of mobile banking application development:

- The Allied Market Report suggests that the market of global mobile banking stood at $715.3 million in 2018. Plus, it is speculated to rise up to $1,824.7 million by the year 2026 at a CAGR of 12.2%.

- People within the age group of 25-34 use banking apps most frequently. The usage rate is 21.6%, followed by those of 35-44 years and so on. People over 65 years of age have the lowest rate of banking app usage (8.5%).

- In the current condition, where social distancing is a must, it has become inevitable for people to ignore the use of a banking app. So, developing a banking application is a great idea to implement.

How to Make a Banking Application?

The road to mobile banking application development is an easy one if you consider all the indispensable aspects and take one thing at a time.

So, before you jump into the development formalities of the banking application, you need to make sure if your application idea is viable or not.

Stage 0. Before the Development

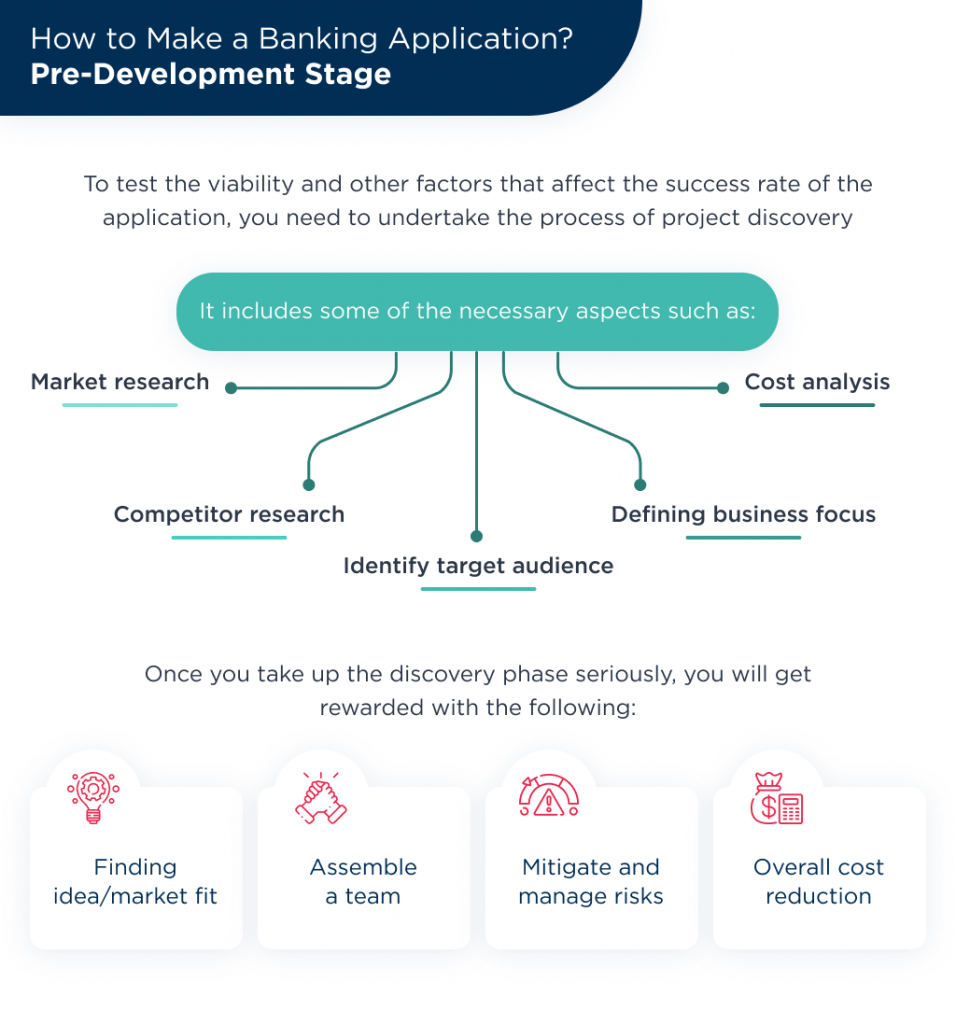

To test the viability and other factors that affect the success rate of the application, you need to undertake the process of project discovery.

The project discovery stage is the foundational stage, not just for banking app development but for any other type of application.

It includes some of the necessary aspects such as:

| Aspect | Description |

| Market research | As 42% of businesses fail due to the lack of a market fit product, it is crucial for you to conduct thorough market research.

And if we talk about the banking sector, it needs apps like these for maintaining a streamlined workflow and retaining their valuable customers. |

| Competitor research | There is always room for improvement. And you will get to know this by doing a competitor’s research. Download their banking app and check how its UI and UX work.

Find out what you can do to enhance it. Closely check the security, reliability, language, and convenience factors of the app. Competitors are your best teachers when you are looking to do something unique. It is the best way to learn from their mistakes and innovate. |

| Cost analysis | No matter how ingenious your idea is. Without enough money, you won’t be able to develop a robust banking app.

The discovery phase helps you estimate the banking app development cost. This will include everything from banking app developers fees, cost of hosting, adding features, making MVPs and prototypes, etc. |

| Business goal | To excel at developing the best banking app, it is necessary to have a crystal clear idea of what you want from it.

As long as one is not focused on his or her business goal, they may end up in the 13% of the startups that fail due to losing their focus. |

| Identify target audience | If you have undertaken the market research process well, then this will be a bit easy for you. But it doesn’t mean you can leave this.

After all, it’s the users that will be using your app. So, it is necessary to check if they need your app. And if they do, which users need it. Gen X, Gen Z, and Millennials should be your primary target audience for a banking application. |

What Are the Pros of the Discovery Phase?

If you are a founder and take up the discovery phase of your banking application seriously, you will surely get rewarded with the following:

- Validates the idea: This phase will validate the viability of the idea. Thus, leading to the development of a market-fit product.

- Assemble a team: With proper knowledge of the overall process requirements, you will be able to get the best team of banking app developers, designers, managers, marketers, etc.

- Risk management: Every new thing poses a risk, but you can convert it into a calculated one. With an agile discovery method, you can estimate potential issues that you may face and plan ahead to counteract them if they happen. You can reduce banking app development costs, prevent missing deadlines, and can also foresee your target clearly.

- Overall cost reduction: When you undertake the project discovery process, you get to know a lot about the application development process. Steps like documentation, MVP, core development, designing, prototyping, testing, distribution, and marketing can be planned ahead. This helps save a lot of cost as compared to when everything is done on the spot.

As a founder, the project discovery phase will help you produce the best banking application in the market with utmost efficiency.

Stage 1. Development

So, now we are at the core part of the app.

After you have a clear vision about your goal and have planned everything out from the start till the end, it is time to jump into the development stage.

The banking app development stage includes features that you need to add to your application to make it stand out.

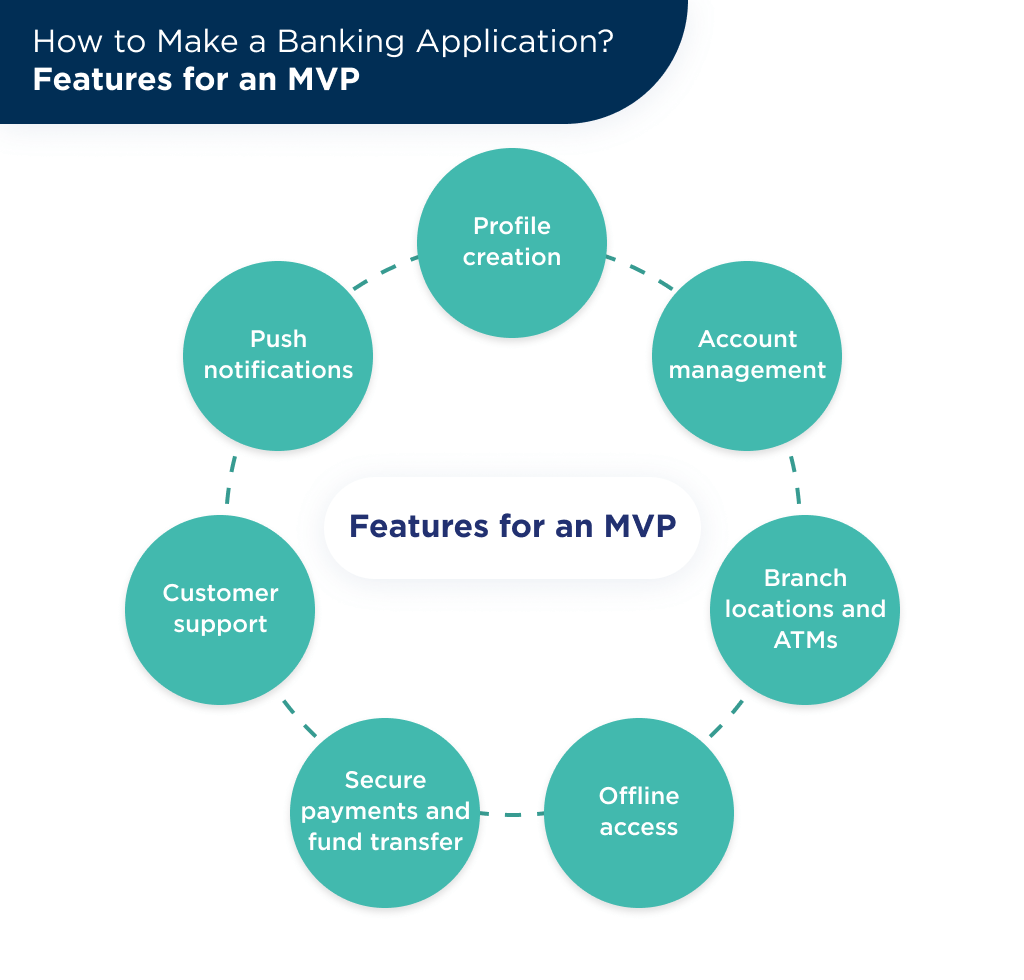

There are many basic features that your application needs to have so that it can cater to the basic requirements of the customers.

List of Core Features of a Banking App MVP

Here are some core features that are a must-have for your banking app!

| Feature | Description |

| Account or profile creation | If you have a banking app, you need to add the feature of account creation for the users. This will help them log in securely into the app with the account ID and password.

To enhance login security and speed, you can use biometric authentication or multi-factor authentication. An excellent example of this is the Standard Chartered Bank mobile app. It allows the users to login into their accounts with their fingerprints. |

| Account management | The account management aspect of the mobile banking application should allow the users to:

It is also possible to add add-on account management features like setting saving goals, managing repeat payments, etc. |

| Branch locations and ATMs | It will be tough to find ATMs for someone who has just started using the services of the bank.

To save them the hassle of searching the web, you can include the location of ATMs and bank branches in the app itself. You can enhance this feature by providing information about the nearest ATMs. However, you will need location access from the user. This feature is in most banking apps. |

| Secure payments and fund transfer | Banking apps of today are not just limited to providing account details, transaction history, etc. They also allow their users to receive and send payments.

Hence, it is necessary to add this feature to the application. Add this feature to the app while keeping the security of the transaction in mind. Use features like OTP authentication for funds transfer. Moreover, allow the users to scan a QR code for making payments for services like movies, groceries, goods, etc. It is one of the most popular & safe methods of paying. In 2019, 10.44 million households in the US scanned a QR for paying. Google Pay, which is not exactly a banking app but a payments application allows the users to pay via scanning a QR code. We at SpdLoad also developed a QR code payment application, Smartpolka. React, React Native, and Laravel was the technologies used in it. |

| Push Notifications and Alerts | This is one critical feature of a banking application. You need to assure that your users are communicated about every little thing that happens with their account.

With push notifications, you can keep your users aware of every financial transaction that happens in their accounts. Moreover, with notifications, you can also keep them aware of your new plans and policies. However, you need to ensure that these notifications are not unwelcoming for the users. Create a communication strategy for this first! |

| Customer Support (Human & AI) | If you have an application, it will never be perfect; you have to keep making efforts to make it better.

But, how will you know what’s wrong? Yes, your customers will be your key source for this information, and the customer service feature will connect you to them. With the customer support feature in the app, you can know about the issues faced by the customers. It may also enlighten you with app issues if any. Based on this, you can make improvements to your banking application. You should know that a customer support executive will not be available 24×7. Hence, it is critical to have a backup. A chatbot will be an innovative addition to your app. It can help in handling customer queries in the inactive hours. American Express is the banking app that leverages the power of a chatbot to serve its customers. |

| Offline access | You can add this feature to your app to make it available to users if their internet connection is weak or completely disconnected. |

To serve the users, these features are enough. However, if you want to retain the users for a long and want to level up to the competition in the market, you need to integrate some out-of-the-box features in the banking app development process.

Read more about banking application development here.