- According to Visa, Tap-To-Pay transactions grew by 30% over the past years.

- Nearly 50% of US shoppers say they won’t shop at a store that doesn’t offer a cashless way to shop.

Every business, whether offline or online, needs a payment processor and payment processing services to cater to the changing behavior of consumers. Besides ensuring the transactions are carried out seamlessly, it also improves customer experience and business reputation.

Since payment processing directly impacts your revenue, making informed decisions is crucial, especially selecting the right payment processors. After all, the payment processor you choose affects everything from your potential to collect online payments, to your customer service, to your business’s bottom line.

Choosing the one payment processor that’s a good fit for your business may sound an uphill task. But, considering the main things like fee structure, PCI compliance, and excellent customer support, it’s simple as ABC.

Before we dive deep into understanding the nitty-gritty of choosing the right payment processors, it’s important to have a quick rundown of where it all started – “Payment Processing Services.”

In simple terms, payment processing is providing a person, indirectly or directly, different means to charge or debit bank accounts through the use of any payment mechanism.

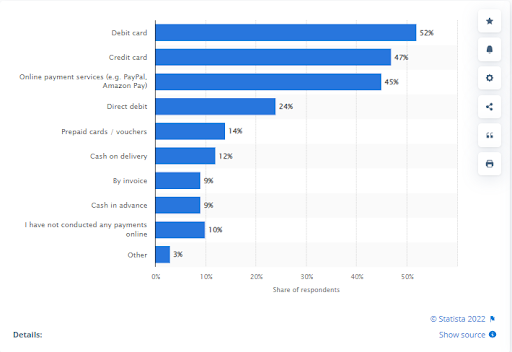

Payment processing is not just about credit or debit cards, it’s much more than that. Though debit and credit cards are the most popular payment method at this time, more options to accept payments are cementing their footstep in the hierarchy, like contactless, mobile and online payments.

Therefore, offering consumers more efficient ways to pay for goods is a key objective for all modern business owners.

To start, let’s first review what and how payment processing work, including terms that specifically relate to your business.

Introduction to Payment Processing:

To a naked eye, the payment processing might seem as simple as a credit or debit card tap, swipe or a dip, merely taking a few seconds. However, there’s more than that. It involves several steps and players, like:

- Customers

- Merchant/Business

- A payment processor

- Payment gateway

- Bank, credit or debit company

- Business bank or merchant accounts