The landscape of investment has undergone a seismic shift with the advent of cryptocurrencies. Gone are the days when stocks and bonds were the only options for investors. Today, we stand at the precipice of a new era, one dominated by digital currencies and blockchain technology. This article aims to shed light on two key investment avenues in this burgeoning field: crypto coin investment and crypto fund investment.

The Rise of Cryptocurrencies: A New Dawn for Investors

Cryptocurrencies, or digital currencies, have taken the world by storm. These decentralized forms of currency, secured by cryptography, offer a level of security and anonymity previously unseen in the financial world. The most well-known of these, Bitcoin, has become synonymous with the term "cryptocurrency." However, the crypto landscape is vast, with thousands of coins, each with its own unique features and potential for growth.

Understanding Crypto Coin Investment

Crypto coin investment refers to the direct purchase of individual cryptocurrencies. Investors buy coins with the hope that their value will increase over time, yielding significant returns. This form of investment is akin to buying stocks in a company, where the investor owns a piece of the entity. The allure of crypto coin investment lies in its potential for high returns. Stories of early Bitcoin investors becoming millionaires have fueled the popularity of this investment avenue.

Diversifying with Crypto Fund Investment

On the other hand, crypto fund investment offers a different approach. Crypto funds are pooled investment vehicles that hold a diversified portfolio of cryptocurrencies. This method provides investors with exposure to a range of digital assets, reducing the risk associated with investing in a single coin. Crypto funds are managed by professionals who make strategic decisions to maximize returns and mitigate risks. This makes crypto fund investment an attractive option for those who wish to invest in cryptocurrencies but need more expertise or time to manage their own portfolios.

Navigating the Volatile Waters of Crypto Investment

Investing in cryptocurrencies has its challenges. The market is known for its volatility, with prices fluctuating wildly in short periods. This unpredictability can be daunting for investors, especially those new to the crypto space. However, with proper research, risk management, and a long-term perspective, investors can navigate these turbulent waters and potentially reap substantial rewards.

The Future of Crypto Investment: A Promising Horizon

As the world becomes increasingly digital, the role of cryptocurrencies in the investment landscape is set to grow. With advancements in blockchain technology and increasing mainstream acceptance, the potential for crypto investments is vast. Whether through direct coin investment or diversified fund investment, the opportunities in this dynamic field are boundless.

Conclusion:

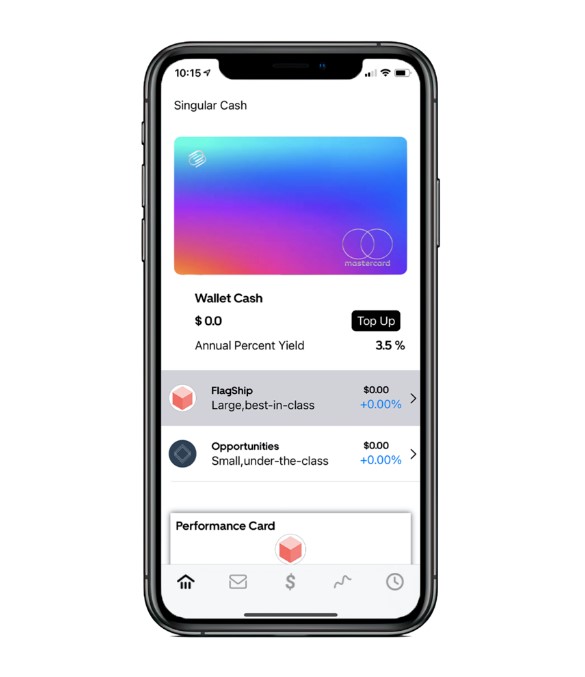

For those looking to embark on their crypto investment journey, choosing the right platform is crucial. singularvest.com offers a comprehensive suite of investment options, catering to both seasoned investors and beginners.

Blog Source URL:

https://singularvest.blogspot.com/2024/03/navigating-future-of-finance-guide-to.html