Clinical Research Organizations Cost and Pricing Analysis

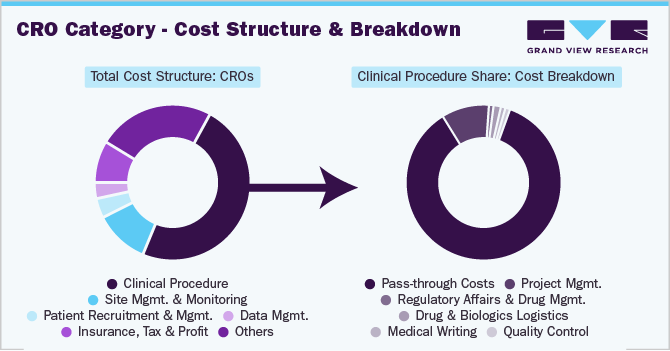

In this clinical research organization intelligence report, we have estimated the pricing of the key cost components. The cost of CROs can vary depending on the specific services offered and the scope of the trial. However, some of the most common cost components like cost of hiring staff, purchasing equipment, developing software, cost of data management, site monitoring, and regulatory compliance. The cost of CROs is also influenced by several factors, including the size and complexity of the trial, the number of sites involved, regulatory requirements, patient population, specific services offered, geographic location, technology use, experience, and quality of the CRO.

For instance, larger and more complex trials require more resources, time, and money, while trials with multiple sites require more management and monitoring. Rare diseases or patient populations with special needs also increase the cost of CROs. The use of technology, such as electronic data capture systems, can reduce costs. Experience also plays a role in the cost of CROs, as more experienced CROs can conduct trials more efficiently and effectively, leading to lower costs.

Order your copy of the Clinical Research Organizations category procurement intelligence report 2023-2030, published by Grand View Research, to get more details regarding day one, quick wins, portfolio analysis, key negotiation strategies of key suppliers, and low-cost/best-cost sourcing analysis

Operational Capabilities - Clinical Research Organizations

Geographic Service Provision - 35%

Years in Service - 15%

Employee Strength - 15%

Revenue Generated - 15%

Key Clients - 12%

Certifications - 8%

Functional Capabilities - Clinical Research Organizations

Patient management (Patient recruitment, Patient retention, Patient monitoring, Others) - 40%

Site management (Site recruitment, Site retention, Site monitoring, Others) - 40%

Others (Physician recruitment, Data management, Regulatory affairs management) - 20%

Rate Benchmarking

The benchmarking process involves comparing the rates charged by different CROs for their services to establish industry standards and identify outliers. Rates in the clinical research industry can vary significantly based on factors such as labor, geographical location, the complexity of the study, therapeutic area, and the size and reputation of the CRO. For example, a reputable CRO in the United States may charge an average rate of $2,500 per patient, while a similar CRO in India could charge around $1,500 per patient. It is important to note that benchmarking rates solely based on cost may not provide a complete picture of the quality and value of the services offered. Factors such as expertise, infrastructure, compliance with regulations, and efficiency should also be considered to make informed decisions when selecting a CRO for clinical research studies. Regularly updating benchmark data can help sponsors and stakeholders to make informed decisions and negotiate fair pricing contracts with CROs, ensuring successful and cost-effective clinical trials.

List of Key Suppliers

- Asymchem Laboratories (Tianjin) Co., Ltd

- Charles River Laboratories.

- Dalton Pharma Services

- ICON plc

- IQVIA Inc

- Pharmaron Beijing Co., Ltd.

- Piramal Enterprises Ltd.

- Sun Pharmaceutical Industries Ltd.

- Syneos Health

- Thermo Fisher Scientific Inc.

Supplier Newsletter

- In June 2023, Clinical Research Management (CRM), a global CRO, acquired TrialSpark, a CRO that specializes in decentralized clinical trials, for $150 million. The acquisition of TrialSpark is a sign of the growing importance of decentralized clinical trials. As the industry moves towards more patient-centric trials, decentralized trials will become increasingly common.

- In February 2023, IQVIA acquired Enlight Bioanalytics for $400 million. The acquisition was intended to help IQVIA to expand its capabilities to use AI and ML in clinical trials. The company also said that Enlight Bioanalytics's expertise in decentralized clinical trials would be a valuable addition to its portfolio of services.

- On July 2, 2021, Parexel, a U.S.-based global clinical research organization (CRO), announced a merger agreement under which the company would be acquired by EQT Private Equity and Goldman Sachs for USD 8.5 billion. The acquisition was completed on November 15, 2021. EQT Private Equity and Goldman Sachs are both experienced investors in the healthcare industry. They have a strong track record of investing in and growing businesses and are committed to supporting Parexel's growth and innovation.

Browse through Grand View Research’s collection of procurement intelligence studies:

- Office Supplies Procurement Intelligence Report, 2024 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

- Media Buying and Planning Procurement Intelligence Report, 2023 - 2030 (Revenue Forecast, Supplier Ranking & Matrix, Emerging Technologies, Pricing Models, Cost Structure, Engagement & Operating Model, Competitive Landscape)

Clinical Research Organizations Procurement Intelligence Report Scope

- Clinical Research Organizations Category Growth Rate : CAGR of 12.2% from 2023 to 2030

- Pricing Growth Outlook : 3% - 4% (Annually)

- Pricing Models : Cost plus pricing

- Supplier Selection Scope : Cost and pricing, past engagements, productivity, geographical presence

- Supplier Selection Criteria : Technical expertise, experience, cost and quality of service, capabilities, and reliability, research and development, customer service

- Report Coverage : Revenue forecast, supplier ranking, supplier positioning matrix, emerging technology, pricing models, cost structure, competitive landscape, growth factors, trends, engagement, and operating model

Brief about Pipeline by Grand View Research:

A smart and effective supply chain is essential for growth in any organization. Pipeline division at Grand View Research provides detailed insights on every aspect of supply chain, which helps in efficient procurement decisions.

Our services include (not limited to):

- Market Intelligence involving – market size and forecast, growth factors, and driving trends

- Price and Cost Intelligence – pricing models adopted for the category, total cost of ownerships

- Supplier Intelligence – rich insight on supplier landscape, and identifies suppliers who are dominating, emerging, lounging, and specializing

- Sourcing / Procurement Intelligence – best practices followed in the industry, identifying standard KPIs and SLAs, peer analysis, negotiation strategies to be utilized with the suppliers, and best suited countries for sourcing to minimize supply chain disruptions