The Insurance Industry in Thailand

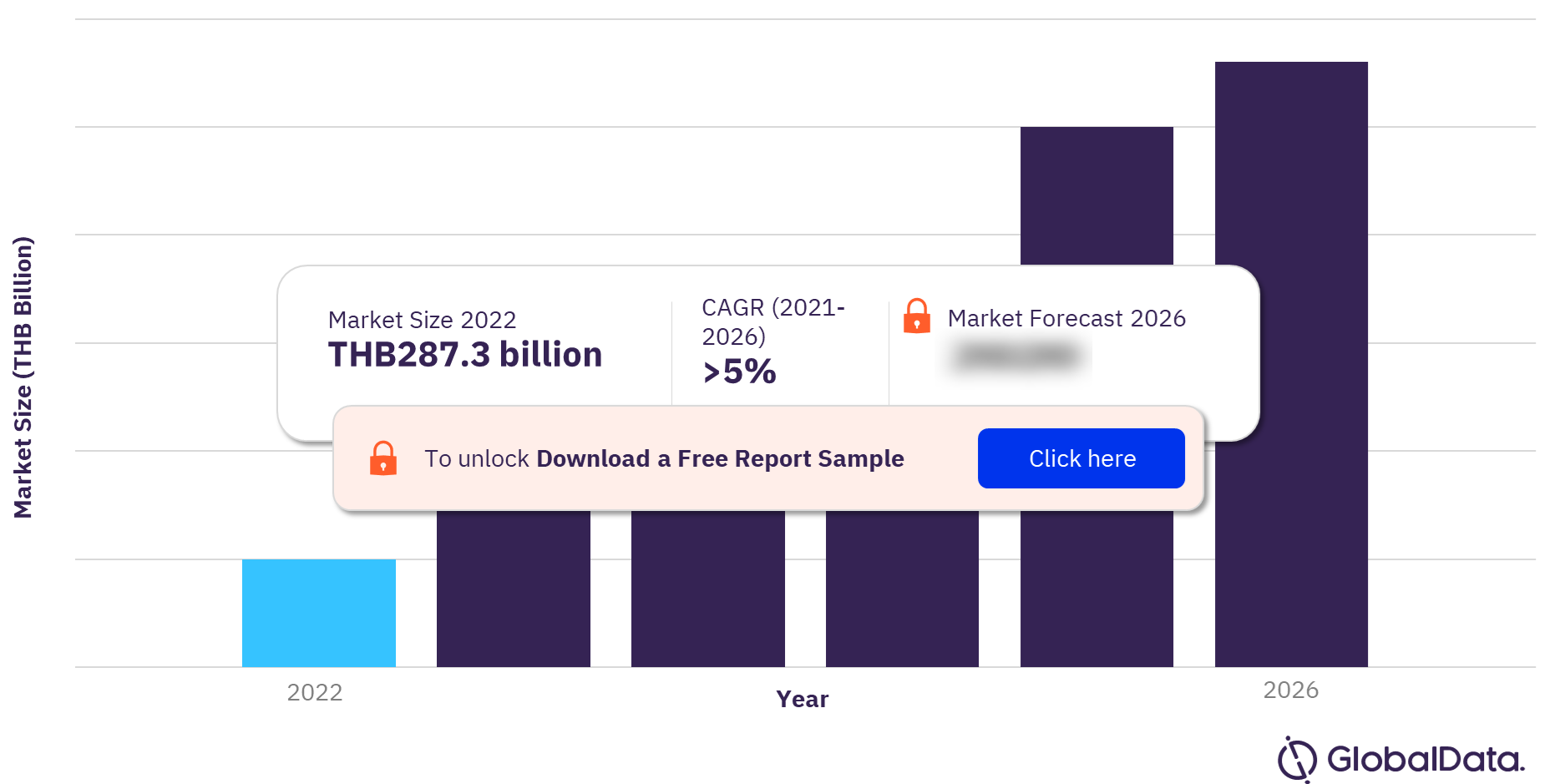

Thailand's insurance market has experienced significant growth and transformation in recent years. As the country's economy continues to develop, the demand for general insurance has increased, creating numerous opportunities for both insurers and consumers. In this article, we will explore the current state of the insurance industry in Thailand, including the key players, market trends, and regulatory framework.

Insurance Regulations in Thailand

When it comes to the insurance industry, regulations play a crucial role in ensuring fair practices and protecting consumers. In Thailand, the regulatory framework for insurance is overseen by the Office of Insurance Commission (OIC). The OIC is responsible for supervising and regulating all insurance companies operating within the country.

One of the key regulations in Thailand's insurance industry is the requirement for insurers to obtain a license from the OIC before they can operate legally. This license is only granted to companies that meet certain criteria, including financial stability, governance practices, and market conduct. The OIC also sets minimum capital requirements for insurers to ensure their ability to meet policyholders' claims.

Additionally, the OIC plays an active role in consumer protection by monitoring and enforcing fair treatment of policyholders. They have established guidelines on product disclosures, pricing transparency, and claims handling to safeguard the interests of consumers.

Finding the Best Insurance in Thailand

With a wide range of insurance products available in Thailand, finding the best one that suits your needs can be a daunting task. However, with expert insights and careful consideration, you can navigate through the market with confidence.

1. Identify Your Insurance Needs: Before starting your search for insurance, it is crucial to assess your specific needs. Determine the type of coverage you require, such as health insurance, car insurance, or property insurance. Consider factors such as your budget, risk tolerance, and specific coverage requirements.

2. Research and Compare Insurance Providers: Once you have identified your insurance needs, research and compare different insurance providers in the market. Look for reputable companies with a proven track record of delivering excellent service and prompt claims settlement. Consider factors such as financial stability, customer reviews, and the range of products they offer.

3. Read Policy Terms and Conditions: Before making a decision, carefully study the terms and conditions of the insurance policies you are considering. Pay attention to the coverage limits, exclusions, deductibles, and any additional benefits or riders that may be available. Ensure that the policy meets your specific requirements and provides adequate coverage.

4. Seek Professional Advice: If you feel overwhelmed or uncertain during your research, consider seeking advice from a professional insurance advisor or broker. They can provide expert insights on the different insurance options available and help you make an informed decision.

5. Evaluate Customer Service: Excellent customer service is crucial when it comes to insurance. Look for insurers with a reputation for providing prompt and efficient customer support. Consider factors such as accessibility, responsiveness, and the ease of claims process.

6. Consider Premiums and Affordability: While it is essential to find insurance that meets your needs, affordability is equally important. Compare premiums from different insurers and evaluate the value for money they offer. Be cautious of policies with extremely low premiums, as they may have hidden costs or inadequate coverage.

7. Stay Informed about Market Trends: To make informed decisions about your insurance coverage, staying updated on market trends is vital. Follow industry news, attend seminars or conferences, and keep an eye on any changes in insurance regulations in Thailand. This knowledge will help you adapt your coverage as needed and stay ahead of potential risks.

Conclusion

Navigating Thailand's general insurance market may initially seem complex, but with expert insights and careful consideration of your insurance needs, you can find the best coverage for your requirements. The insurance industry in Thailand continues to evolve, driven by economic growth and regulatory measures implemented to protect consumers. By understanding the insurance regulations in Thailand and following the steps outlined above, you can make informed decisions and ensure that you are adequately protected against potential risks.