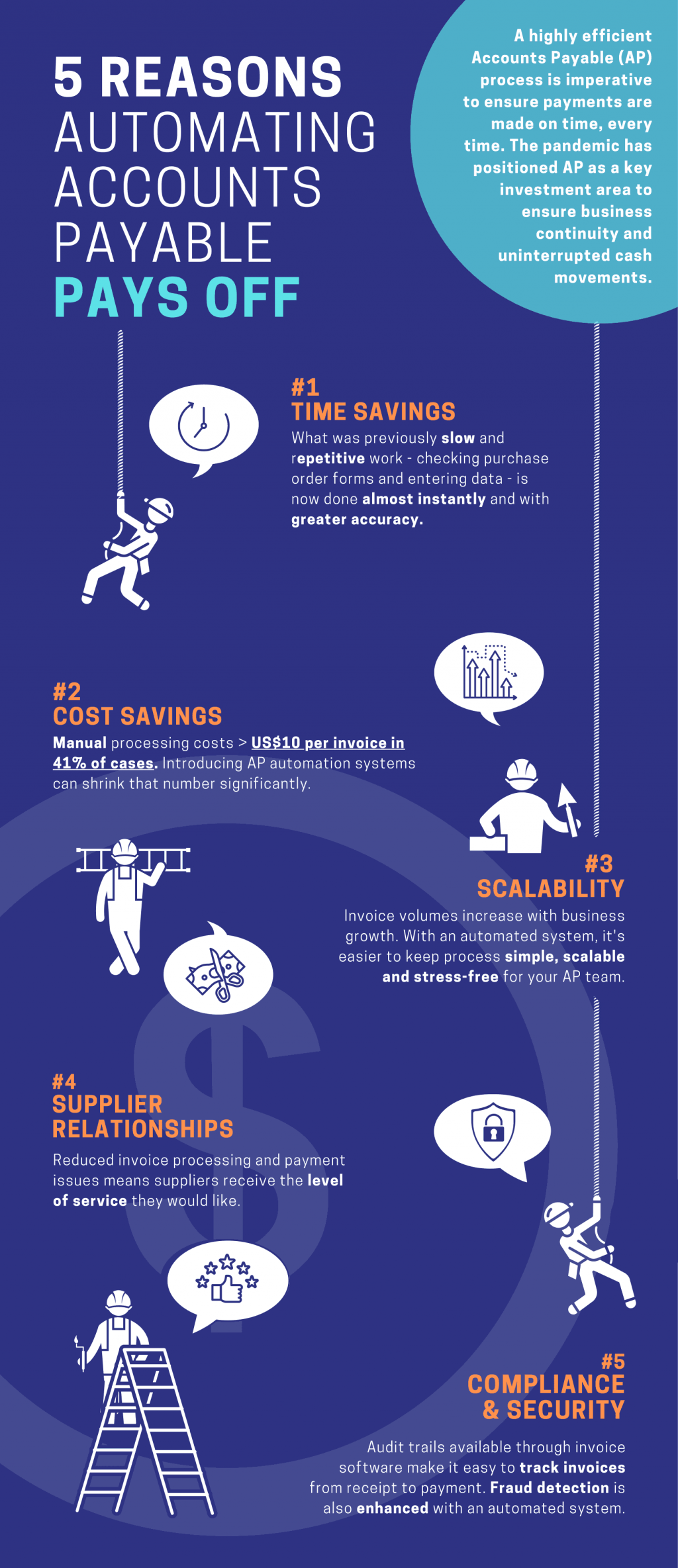

The payments industry has been undergoing a transformation over the past few years. One of the key drivers of this change is the adoption of automation technology. In this article, we will explore how automation can help companies optimize their accounts payable process namely AP automation, increase cash flow and net profitability, and provide financial stability. In today’s business climate, it is crucial to deliver a top-tier customer experience and provide good value at the same time. This can be achieved by pursuing operational efficiency within an organization. Accountants have been struggling with this topic for years: in order to achieve these goals, they must focus on both controlling and automating their processes. Automation allows accountants to focus on value creation and minimize risk, while still providing customers with a great experience. To drive the point home, let’s take a look at how automation can help one company reduce its operating costs and increase cash flow.—Automated Payments: Key Benefits for Commercial Companies (2018) Automation allows accountants to focus on value creation and minimize risk, while still providing customers with a great experience. This can be achieved by pursuing operational efficiency within an organization. and by automating processes and interactions with the client base. To drive the point home, let’s take a look at how automation can help one company reduce its operating costs and increase cash flow.—Automated Payments: Key Benefits for Commercial Companies (2018) Automation allows accountants to focus on value creation and minimize risk, while still providing customers.