In today's dynamic business landscape, organisations are continually seeking innovative ways to streamline operations, enhance efficiency, and boost their bottom line. One such transformative solution gaining widespread recognition is the outsourcing of accounts payable (AP) functions. As businesses grapple with the complexities of financial management, outsourcing AP functions has emerged as a game-changer, offering a plethora of advantages that extend beyond mere cost savings. This article delves into the myriad benefits of an outsourced AP service, shedding light on why this strategic decision can catalyse positive change and propel your business towards heightened productivity and success. From improved accuracy and compliance to enhanced scalability and focus on core competencies, the advantages of outsourced AP services are manifold, making it a pivotal strategy for organisations navigating the challenges of the modern business landscape.

Benefits of Outsourced Accounts Payable Services

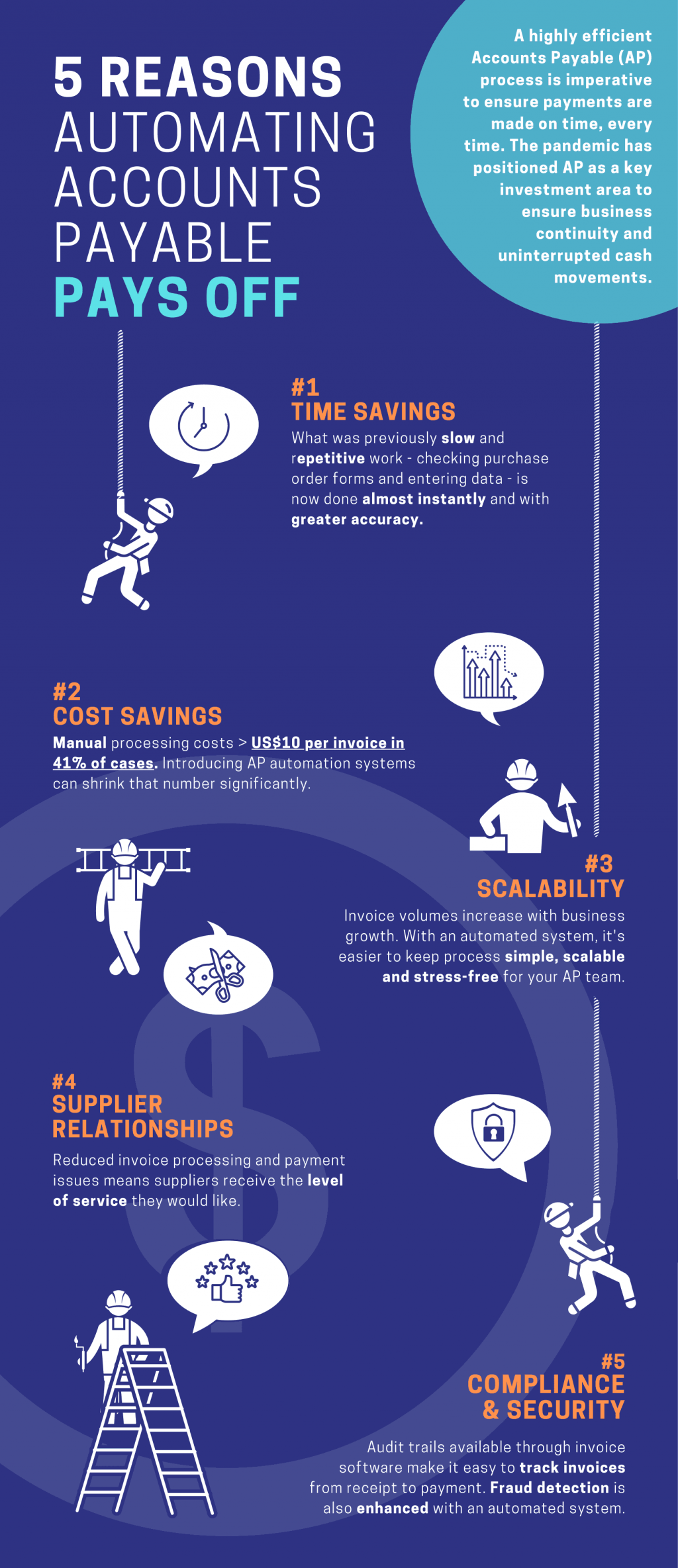

- Cost Efficiency: Outsourced accounts payable services can lead to significant cost savings for businesses. By leveraging the expertise of external service providers such as remote accountant, organisations can reduce operational costs associated with in-house AP processes, such as staffing, training, and technology investments. This cost efficiency allows companies to reallocate resources to core business functions and strategic initiatives.

- Enhanced Accuracy and Compliance: Professional outsourced AP service providers specialise in maintaining accurate and compliant financial records. Outsourcing AP functions ensures adherence to industry regulations and best practices, minimising the risk of errors and regulatory non-compliance. This not only safeguards the company's financial integrity but also fosters trust among stakeholders.

- Improved Processing Speed: An outsourced AP service often comes equipped with advanced technologies and streamlined processes, leading to faster invoice processing and payment cycles. The efficiency gains translate to quicker turnaround times, reducing the likelihood of late payments and enhancing relationships with vendors and suppliers.

- Scalability and Flexibility: Businesses experience fluctuations in transaction volumes and operational demands. Outsourced AP service providers offer scalability and flexibility to adapt to changing business needs. Whether during periods of growth or economic downturns, organisations can easily adjust the level of AP support required without the challenges associated with in-house resource management.

- Access to Expertise: Engaging a specialised AP service provider like a remote accountant grants businesses access to a pool of skilled professionals with expertise in accounts payable processes. These specialists stay abreast of industry trends, technological advancements, and regulatory changes, ensuring that the organisation benefits from the latest knowledge and practices in financial management.

How To Find the Right Outsourced Service Provider?

- Define Your Requirements: Clearly outline your business requirements, goals, and expectations for outsourcing. Identify the specific tasks or processes you intend to outsource and the outcomes you aim to achieve. This initial step will serve as a foundation for evaluating potential service providers.

- Assess Provider Expertise: Evaluate the expertise and experience of potential outsourced service providers in the relevant domain. Look for a provider with a proven track record in delivering high-quality services and a solid understanding of your industry.

- Check Technology and Infrastructure: Examine the technological capabilities and infrastructure of the service provider. Ensure that they employ up-to-date technologies, security measures, and scalable systems to accommodate your business needs. A technologically advanced partner can contribute to enhanced efficiency and seamless integration with your existing processes.

- Cost Structure and Transparency: Understand the cost structure and pricing models of potential service providers. Look for transparency in pricing, with a clear delineation of costs associated with different services. Avoid hidden fees and ensure that the cost structure aligns with your budgetary constraints and financial goals.

Conclusion

In conclusion, embracing outsourced AP service emerges as a transformative strategy, wielding the potential to redefine the financial landscape for businesses. The multifaceted benefits of outsourcing AP, from cost efficiency and enhanced accuracy to scalability and a renewed focus on core competencies, collectively position it as a game-changer in the dynamic realm of modern commerce. By entrusting AP processes to specialised service providers, organisations not only navigate the complexities of financial management with increased efficiency but also unlock opportunities for strategic growth and innovation. As businesses continually seek avenues for operational optimisation, the decision to leverage outsourced AP services stands out as a pivotal choice, offering a pathway to sustained success in an ever-evolving business environment.